Sharpe Ratios Don't Lie: Bitcoin Outpaces Bonds in a Post-60/40 World

A five-year, risk-adjusted performance audit reveals why Bitcoin now delivers compensated volatility while bonds fail to justify their historical safety premium

In both distributed networks and capital markets, raw risk exposure is meaningless without compensation. Just as Bitcoin miners expend energy to secure block rewards—a deterministic risk-reward tradeoff—investors must evaluate whether market volatility is producing sufficient excess return per unit of risk.

This is where the Sharpe Ratio functions as a protocol-level truth oracle for finance. Like Bitcoin consensus rules, which enforce objective validity across a decentralized network, the Sharpe Ratio standardizes the evaluation of heterogeneous assets, cutting through subjective narratives.

From 2020 to 2025, we witnessed the demise of the “60/40” allocation schema, the structural drawdown of bonds under rate normalization, and Bitcoin’s re-emergence as a supply-capped, non-sovereign collateral layer. While all three asset classes—long-duration Treasuries, aggregate bonds, and Bitcoin—produced sharply divergent outcomes in nominal terms, only one demonstrated mathematically superior risk-adjusted efficiency.

Sharpe Ratio as a Consensus Rule for Asset Evaluation

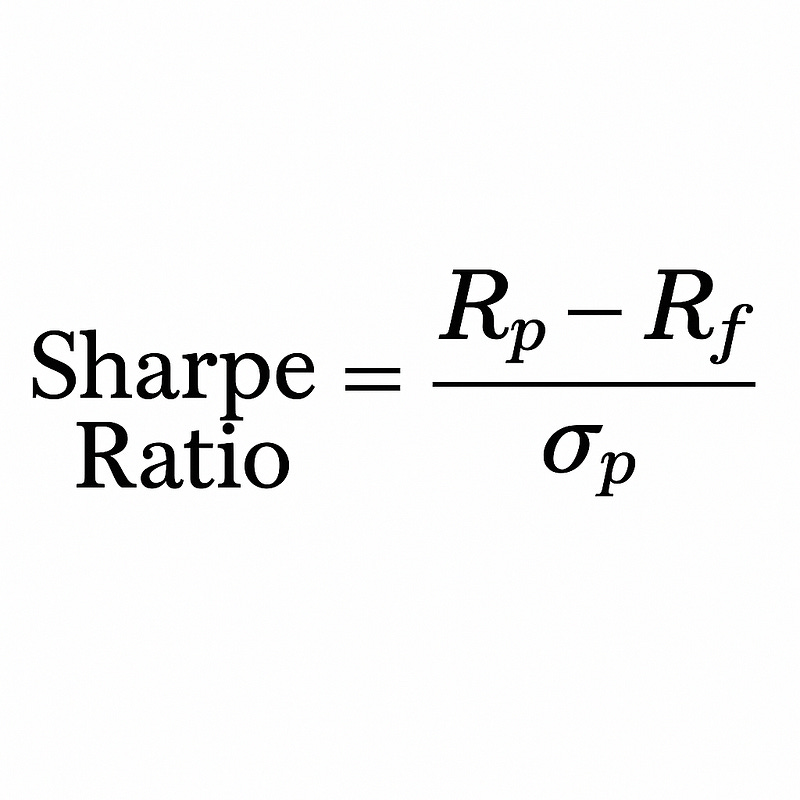

Formally defined by William F. Sharpe in 1966, the Sharpe Ratio measures the excess return per unit of volatility:

Where:

RpR_pRp is the portfolio or asset return over the observation period.

RfR_fRf is the risk-free rate, proxied here by the 5-year average yield on short-duration U.S. Treasuries (~2%).

σp\sigma_pσp is the annualized volatility of the asset or portfolio.

This transforms absolute returns into standardized, volatility-normalized performance—analogous to how Bitcoin difficulty normalizes hash rate variance over time. Sharpe does not ask, “Who made the most money?” but rather, “Who earned the most per unit of stochastic variance endured?”

This framework is essential because volatility is path-dependent, and investors often mistake nominal gains for efficiency. The Sharpe Ratio eliminates narrative bias, compressing performance into a universal signal—similar to how consensus rules validate blocks independently of node opinion.

Empirical Analysis: July 2020—July 2025

Over this five-year span, we examine three distinct instruments, each tied to different macroeconomic exposures:

Long-duration Treasuries (TLT): Sovereign credit with high convexity.

Aggregate bonds (AGG): Broad-based fixed income across Treasuries, mortgage-backed securities, and corporates.

Bitcoin (BTC): A deterministic, digitally scarce asset functioning as non-sovereign collateral.

During this period, TLT experienced a drawdown of approximately 48%, AGG declined by roughly 18%, and Bitcoin appreciated by nearly 77%. The volatility profiles were drastically different: Bitcoin exhibited annualized volatility exceeding 60% in multiple quarters, while bonds remained comparatively muted but negative-yielding in real terms.

When normalized for risk using Sharpe, bonds failed to compensate their holders despite low variance. Bitcoin, by contrast, delivered a Sharpe Ratio above 1.0, signifying “elite” risk-adjusted return—despite high variance. In practical terms, bondholders took risk without reward, while Bitcoin holders endured volatility but were compensated sufficiently.

Protocol-Level Interpretation

Long-Duration Treasuries (TLT)

Exposure to duration, once regarded as “safe carry,” inverted catastrophically as rate normalization collided with inflationary shocks. This was uncompensated risk: volatility absorbed without offsetting reward, analogous to running outdated consensus rules in a network fork.

Aggregate Bonds (AGG)

Diversification across fixed income slightly mitigated drawdown but failed to hedge inflation or provide real yield. This represented compressed upside drift with asymmetric downside—probabilistically equivalent to low-difficulty mining with negative expected value.

Bitcoin (BTC)

Volatility was severe, but its deterministic supply schedule and global liquidity dynamics provided superior excess return. Like proof-of-work difficulty adjustments, Bitcoin’s volatility was “paid for” in compensation. Its Sharpe Ratio validated it as a mathematically efficient exposure in an uncertain regime.

Sharpe as an Objective Judge

Sharpe is indifferent to fiscal policy, central bank signaling, or prevailing market narratives. Its computation is deterministic:

Excess Return over Risk-Free ÷ Observed Volatility\text{Excess Return over Risk-Free} \div \text{Observed Volatility} Excess Return over Risk-Free ÷ Observed Volatility

Nothing more.

Between 2020 and 2025, this calculation rendered an unambiguous judgment:

Bonds represented uncompensated legacy risk masquerading as safety.

Bitcoin offered compensated volatility, with its return stream statistically justifying the variance, where the variance was statistically justified by its return stream.

This mirrors Bitcoin’s own trustless verification: Sharpe offers mathematical proof of efficiency, removing heuristic biases like “bonds are inherently safe.”

Beyond Sharpe: Advanced Risk-Adjusted Metrics

While Sharpe is foundational, it is not exhaustive. Other metrics deepen the analysis by refining how we treat risk asymmetry:

Sortino Ratio

Sortino only isolates downside deviation, penalizing losses without diluting results for upside volatility. For Bitcoin, this is critical: much of its volatility is right-tailed (sharp upside moves). The Sortino Ratio would show that Bitcoin is even more efficient compared to bonds, which have a higher risk of losses without offering enough potential for gains.

Sortino Ratio = Rp−Rfσdownside\text{Sortino Ratio} = \frac{R_p — R_f}{\sigma_{\text{downside}}}Sortino Ratio=σdownsideRp−Rf

Omega Ratio

Omega measures the probability-weighted ratio of gains to losses relative to a threshold return (e.g., 0%). Unlike Sharpe, it evaluates the entire return distribution, integrating fat-tail behavior. Bitcoin’s lognormal payoff distribution—with extreme right-tail events—tends to score highly under Omega, further underscoring its convexity profile.

These metrics are akin to analyzing Bitcoin mining beyond difficulty, incorporating fee market dynamics and orphan rates—moving from a singular view of efficiency to a multidimensional one.

Conclusion: Portfolio Allocation Must Be Quantified, Not Assumed

Legacy allocation heuristics—like 60/40—emerged in a world of stable rates and positive real bond yields. That world has dissolved. In its place, risk must be mathematically audited, akin to validating blocks under deterministic consensus.

From 2020 to 2025, Bitcoin demonstrated a superior risk-adjusted profile, both under Sharpe and under more advanced measures like Sortino and Omega. Bonds, despite their historical perception, offered negative real returns and uncompensated volatility—rendering them structurally obsolete in this framework.

The mandate for the next era of portfolio design is clear:

Audit allocations mathematically, as one would audit Bitcoin transactions.

Reject reflexive trust in legacy instruments.

Embrace deterministic, compensated risk exposures validated through objective metrics.

Just as Bitcoin replaced discretionary monetary trust with algorithmic certainty, portfolio allocation now requires proof-of-efficiency over narrative belief.

You can sign up to receive emails each time I publish.

Here is the link to the original Bitcoin White Paper:

Dollar-Cost-Average Bitcoin ($10 Free Bitcoin): DCA-SWAN

Access to our high-net-worth Bitcoin investor technical services is available now: cccCloud

We solely intend this content for informational purposes. It is not a substitute for professional financial or legal counsel. We cannot guarantee the accuracy of the information, so we recommend consulting a qualified financial advisor before making any substantial financial commitments.