Compression Before Lift-Off: Bitcoin's Late-Cycle Setup for a Q4 ATH

On-chain is still mid-zone, DXY is capped, and spot bid > mapping the $210k base case and the $280k extension into 2026.

Executive Summary

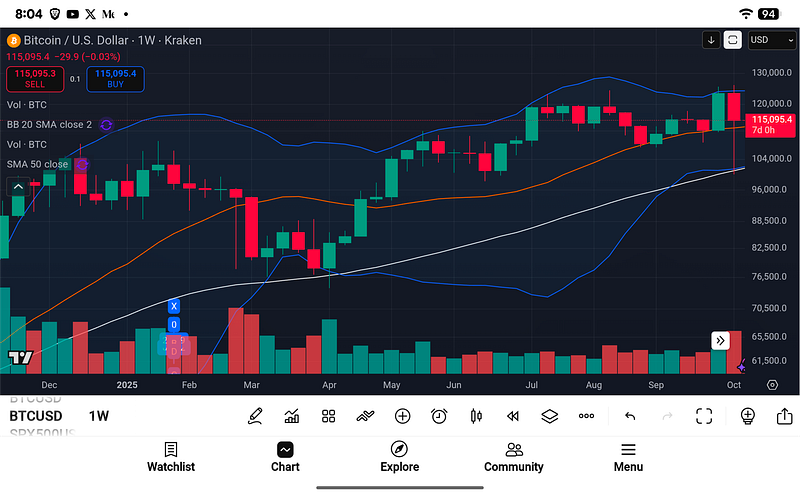

Market structure: BTC is holding the weekly mid-band with higher lows above the SMA-20 and well above the SMA-50, signaling trend continuation after a volatility squeeze.

Macro overlay: A heavy/sideways DXY and a gentle M2 upslope continue to underwrite risk assets—supportive but not euphoric.

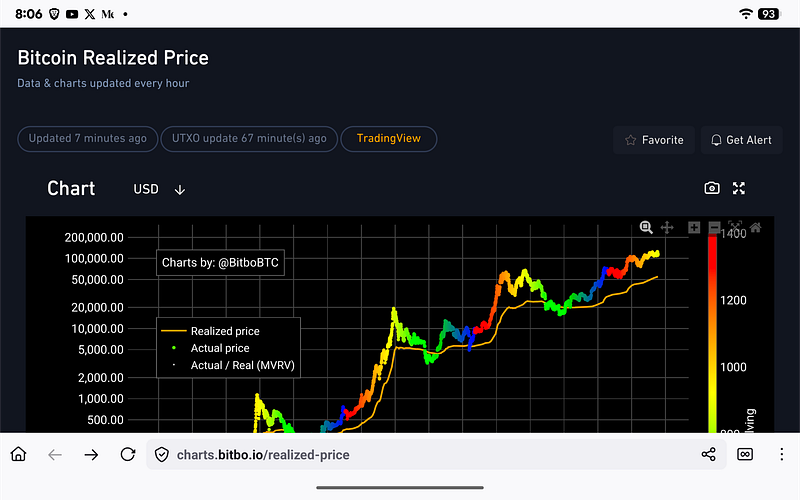

On-chain valuations: MVRV-Z and Puell remain mid-cycle, leaving room before classic blow-off zones. Realized Price keeps stair-stepping up as cost basis accretes.

Base case: Break and hold above prior band high points to a Q4 ATH push toward ~$210k.

Extension case: If institutional spot demand persists and DXY stays capped, the cycle can stretch into Q2 2026, with a measured path to $280k.

Risk: Policy shocks (trade/FX) and a premature buildup of derivatives leverage without spot sponsorship.

TradFi Recap

A tariff headline shock rattled equities; BTC and gold outperformed on the day. Investor flows into BTC held up, while paper liquidity (perps) cooled—counterintuitive for late cycle but constructive: spot > perps reduces liquidation cascades on dips. As always, macro shakeouts resolve over weeks, not days—expect chop while equities digest policy risk.

Market Structure (1W & 1M)

Weekly

Price is riding the upper half of the Bollinger envelope, repeatedly defending the mid-band.

Volume on red weeks stays contained vs. green expansion weeks—a healthy profile of dip absorption.

A weekly close above the recent upper band with expanding bandwidth would confirm trend acceleration.

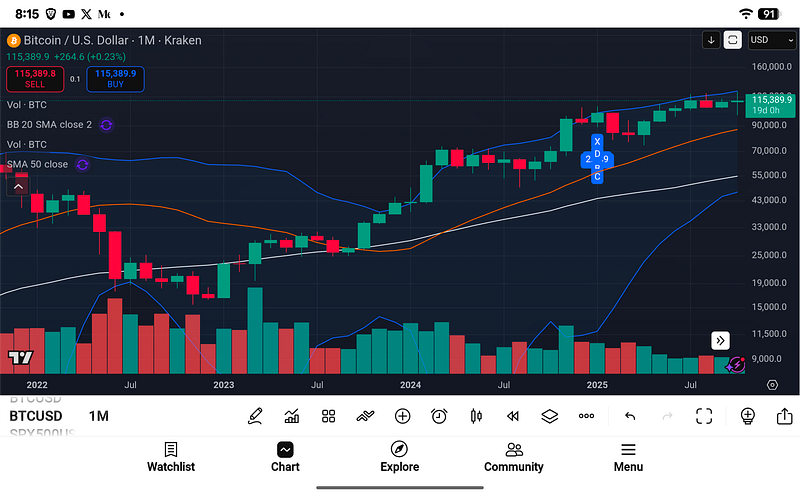

Monthly

The secular uptrend remains intact. Pullbacks are garden-variety consolidations above prior breakout shelves.

Structural damage requires a monthly close below the 20-month basis—not in play.

Red-month volumes remain muted relative to breakout legs: a grind-higher regime.

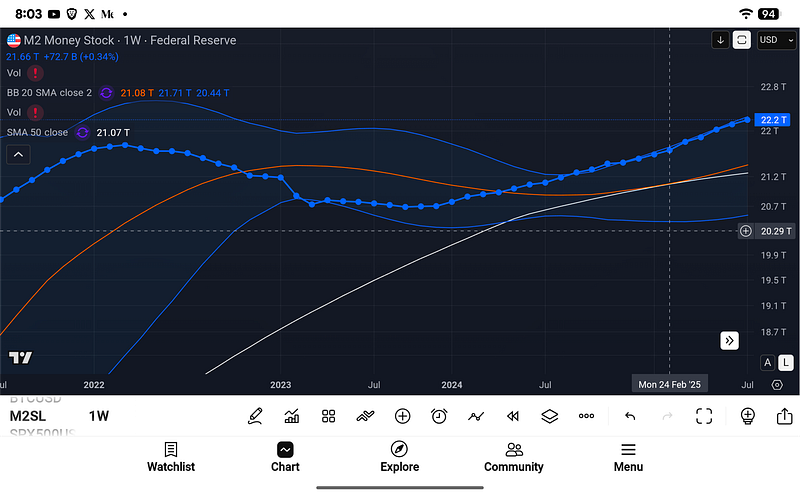

Macro Liquidity & Dollar

M2 Money Stock

M2’s gentle upslope toward the low-$22T region supports rising realized cap. Not a QE-style surge—just steady fuel that lowers the hurdle rate for new highs.

Dollar (DXY)

DXY continues to struggle below its declining 50-week moving average and mid-band indicator. A capped dollar historically loosens BTC upside; only a decisive DXY band expansion up would become a real headwind.

On-Chain Valuation & Miner Stress

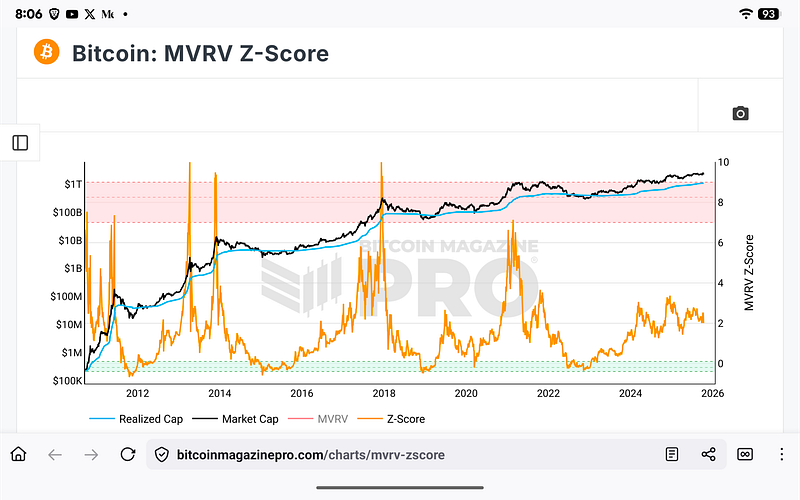

Realized Price & MVRV-Z

Realized Price keeps stepping higher—network cost basis is ratcheting up, creating a rising structural floor.

MVRV-Z sits mid-zone, well below the historical euphoria band seen near cycle peaks. That suggests valuation headroom for another drive.

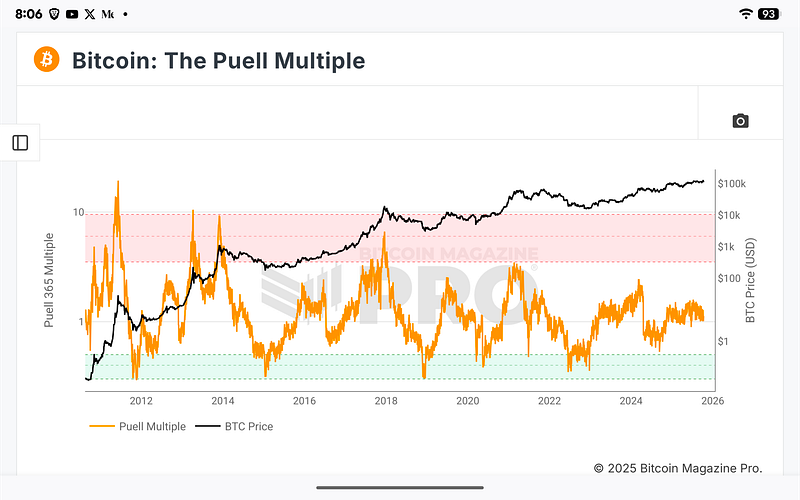

Puell Multiple

The Puell remains neutral-to-constructive: miners are not distressed (capitulation) nor in mania (overheat). With post-halving issuance (3.125 BTC/block), miners need higher USD prices to generate the same cash, which typically pulls offers higher late in the cycle.

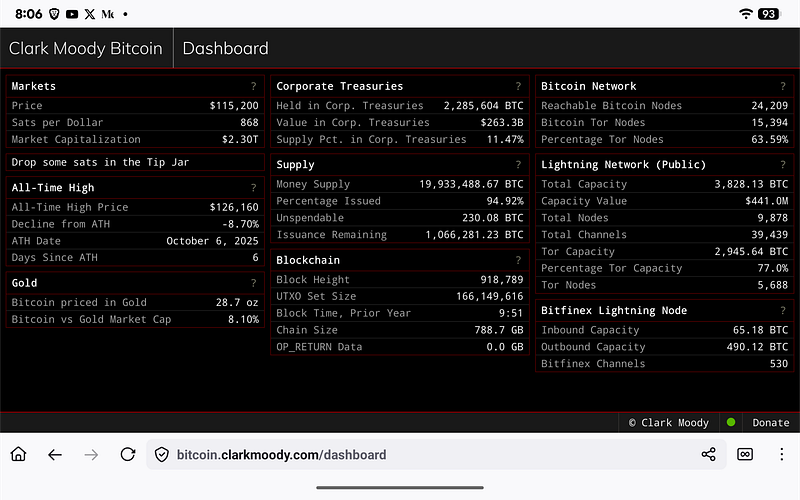

Network Fundamentals

Clark Moody shows: issued supply ≈ 95%, UTXO set >166M (broad distribution), Lightning capacity ~3.8k BTC across ~9.8k nodes and ~39k channels — steady L2 scaffolding for payments throughput.

The chain continues to scale via segwit + batching + L2, while fee markets oscillate with activity bursts; no systemic stress.

Flows, Leverage, and Alt-Rotation

Spot > perps: spot absorption on dips, while perp OI/funding has cooled—late-cycle hygiene.

Alt flows: ETH softened, SOL still ebbing—capital appears to be rotating toward BTC, not exiting crypto.

Time Horizons

Short Term (1–3 weeks)

Fast-response VWAP/fair-value trackers remain not fully recovered from the recent jolt; expect range-bound chop and time decay of fear unless DXY breaks sharply lower (bullish impulse) or equities suffer a second-wave shock (bearish impulse).

Medium Term (4–8 weeks)

The regime remains constructively bullish: realized cap rising, mid-cycle on-chain valuations, and dollar capped.

Trigger: Weekly close above the band highs with expanding Bollinger width → vol expansion in trend direction.

Cycle Map, Projections, and Guardrails

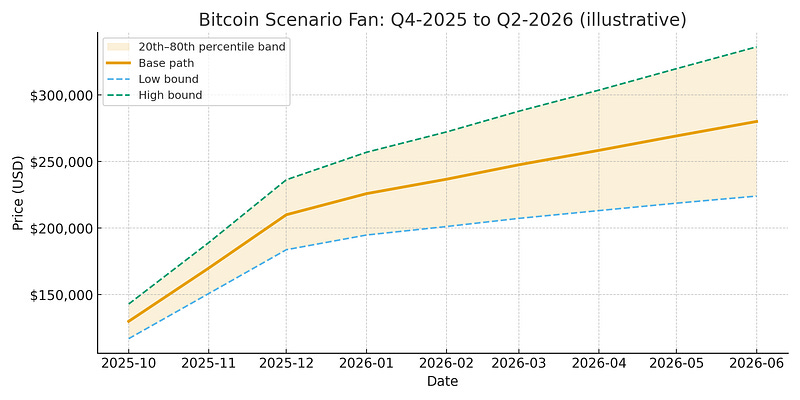

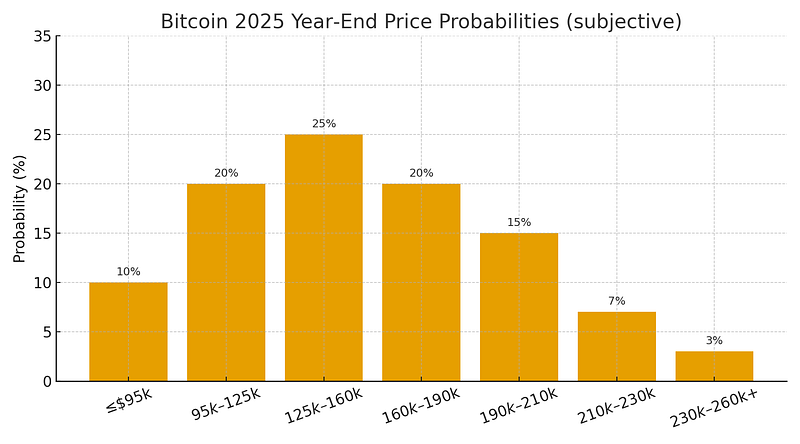

Base Case (favored)—Q4 ATH

Target zone: $180k–$210k into Q4 on successful band expansion, spot-led demand, and steady macro liquidity.

Why: Mid-cycle MVRV-Z and Puell, rising Realized Price, controlled leverage, incremental ETF/institutional bid.

Extension Case (if ETF/spot bid persists)—Q2 2026

Target zone: $240k–$280k with a staircase profile (multiple 20–30% pullbacks), realized cap gliding higher, and valuation bands filling gradually, not spiking.

Bearish Risk Path (guardrail)

Failure to reclaim band highs + DXY up-leg above its 50-week → range back into the $95k–$105k liquidity pocket to rebuild energy. On-chain still argues mean-reversion over trend failure unless weekly SMA-50 breaks and turns into resistance.

Historical Context (2013, 2017, 2021 vs. Today)

2013/2017: Major tops aligned with MVRV-Z in euphoric territory and Puell moving through the red overheat band — we’re not there yet.

2021: Double-top structure saw derivatives leverage outrun spot, followed by forced deleveraging. Today’s pattern is healthier: spot bids dominate, perp froth is intermittent.

Post-halving dynamics across cycles rhyme: declining new supply, rising realized cap, and final volatility expansion before the terminal peak. Our current readings fit late-phase, not terminal.

Risk Checklist

Policy & FX: Trade headlines and FX shocks can spike cross-asset correlations; a decisive DXY band expansion up would tighten conditions.

Leverage: Watch perp OI vs. basis for re-risking that isn’t mirrored in spot.

Miners: Track hashprice and pool outflows; a sudden drop through the weekly mid-band could spur hedging.

Conclusion

BTC’s structure remains resilient. The tape is classic late-cycle—realized cap grinding up, valuation gauges mid-range, pullbacks bought on a weekly basis, and a capped dollar offering macro clearance. Historically, final advances have begun from similar states: 2013’s spring leg, 2017’s late-summer coil, and 2021’s autumn push all saw on-chain metrics travel from neutral into euphoria before the ultimate top.

Our base case remains a Q4 ATH with a credible runway to $210k. If the ETF/spot bid persists and DXY stays contained, the extension case into Q2 2026 toward $280k remains on the table. The biggest near-term risks are policy-driven volatility and any leverage build without spot sponsorship. Until those materialize, the playbook is unchanged: respect the weekly mid-band, buy dips into the basis, keep invalidation tight beneath the 50-week, and let realized cap do its quiet compounding.

You can sign up to receive emails each time I publish.

Here is the link to the original Bitcoin White Paper:

Dollar-Cost-Average Bitcoin ($10 Free Bitcoin): DCA-SWAN

Access to our high-net-worth Bitcoin investor technical services is available now: cccCloud

We solely intend this content for informational purposes. It is not a substitute for professional financial or legal counsel. We cannot guarantee the accuracy of the information, so we recommend consulting a qualified financial advisor before making any substantial financial commitments.