Bitcoin's Ascending Cycle: Why the Top Is Still Ahead

A Technical and Historical Analysis of the 2024–2026 Bull Market with Projections to $225K

Author Note

This analysis is grounded in over 50 years of technical, hardware, and software engineering experience, spanning legacy minicomputers, Unix kernel systems, cryptographic systems, and blockchain architecture. Since 2010, I have tracked Bitcoin from protocol to price level—across every cycle—pairing volatility structure with profitability modeling to build predictive frameworks that anticipate not just direction but behavioral timing.

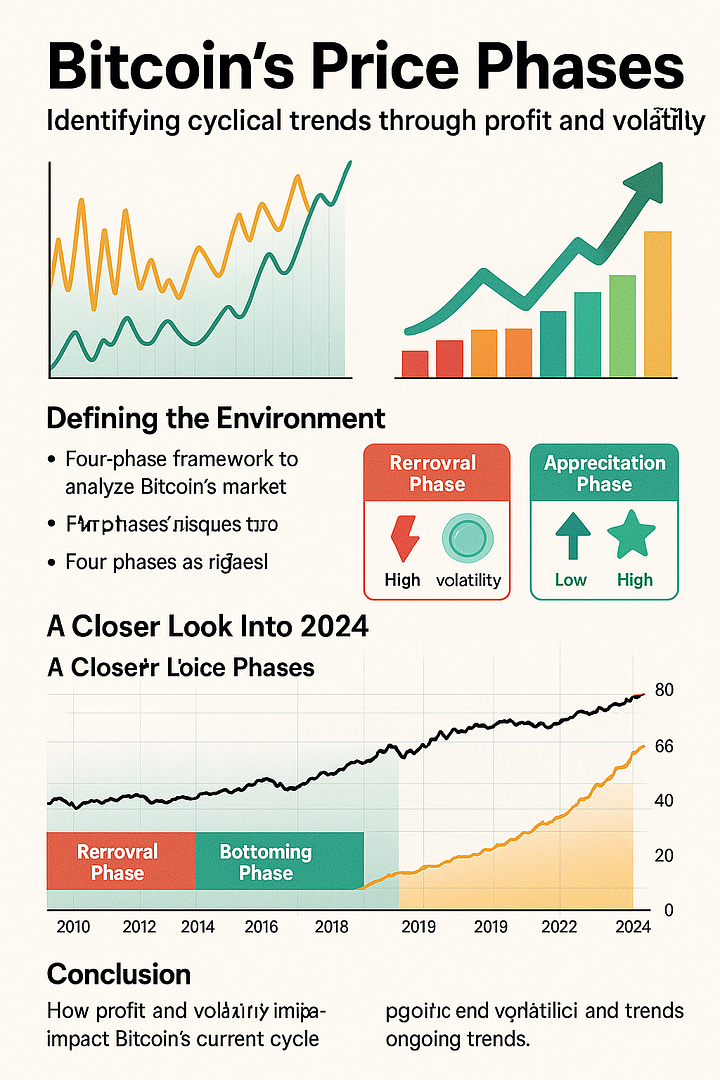

As of Q2 2025, Bitcoin’s price regime continues to follow the historically repeatable pattern I’ve categorized as Reversal→ Bottoming→ Appreciation→ Acceleration. The current market sits deeply within the Acceleration Phase, and I project it will remain there through early Q1 2026.

Cycle Context and Structural Setup

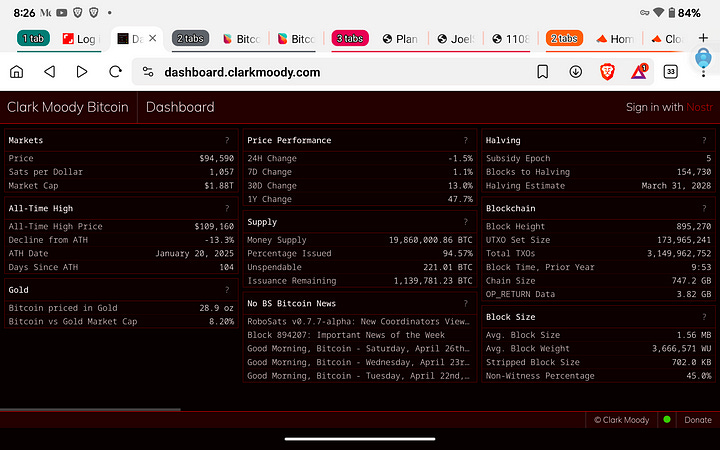

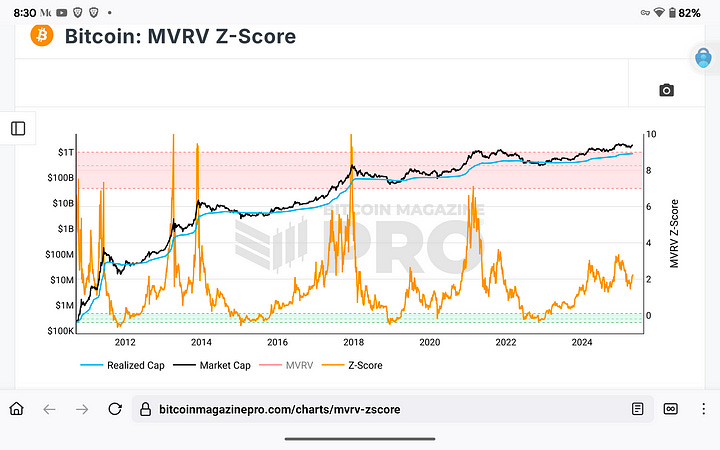

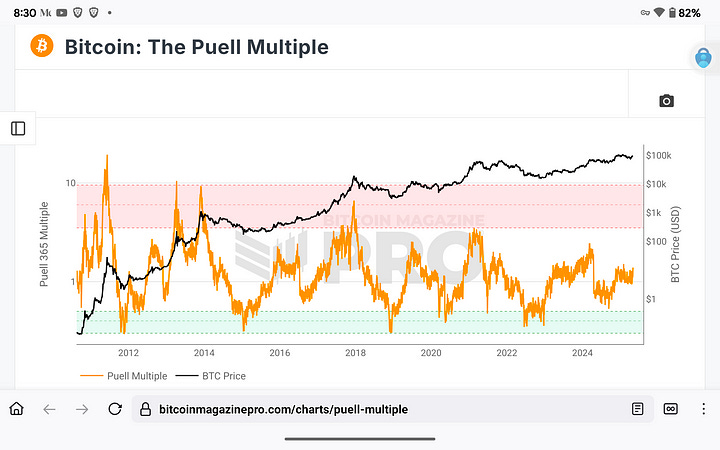

Bitcoin trades near $95,615, following a series of higher lows and reclaiming the 20-week and 50-week EMAs with strength. Weekly MACD is accelerating, RSI is rising toward overbought, and the MVRV Z-score (~3.9) and Puell Multiple (<2.5) confirm this is not yet a terminal top, but a maturing phase with upside extension likely.

From an on-chain perspective:

Over 95% of addresses remain in profit.

One-year realized volatility has exceeded the 5th percentile, confirming the high-volatility+high-profit regime—the technical definition of the acceleration phase.

The Clark Moody dashboard shows a consistent difference between the spot price and the realized price, which has only happened during rapid price increases in past cycles. confirms a lasting gap between the spot price and the realized price — a pattern only observed during sharp price increases in previous cycles.

My Forward Projection: Price Targets Through the Remainder of the Cycle

This phase’s price structure most closely mirrors the blended dynamics of 2013 and 2017 — both of which demonstrated extended upside even after reaching what were then “historic” highs.

I project the following scenario through May 2026:

$120,000 by May 30, 2025

This coincides with the Bitcoin 2025 Conference in Las Vegas, which will act as a liquidity and attention catalyst. The $109K ATH will be breached in June, pushing BTC into full price discovery. ETF inflows, suppressed volatility metrics, and renewed retail re-entry will amplify this move.$160,000 by October 31, 2025

Halloween will mark the psychological climax of the Acceleration Phase. This season will be fueled by high-volume blow-off patterns, RSI divergences, and media-driven momentum — mirroring previous cycle peaks, which often occurred in October–December windows.$198,000 by December 25, 2025

Bitcoin’s Christmas price historically reflects late-cycle overextensions, and this level will be achieved as leverage peaks, the CBBI crosses 90+, and Fear & Greed reaches euphoria.

Cycle Extension into Q1 2026

Unlike 2017 or 2021, this cycle benefits from ETF-based floor demand, a stable miner issuance post-halving, and longer macro adoption curves. I therefore predict that this prolonged cycle will end in May 2026 with a new all-time high of $225,000, concluding this extended cycle.

Technicals Confirming This Projection

Weekly Chart Overview (Kraken: BTC/USD)

The EMAs of 20W and 50W continue to be supportive, exhibiting a strong upward slope. The long-term trend remains intact.

MACD: Accelerating bullish crossover, confirming sustained trend strength.

RSI: Pressing above 70; rising but not yet diverging — a sign we are not at euphoria.

Volume: Rising on up-candles, contracting on retracements — a classic Acceleration Phase signature.

On-Chain Metrics Validating the Extension Thesis

MVRV Z-Score: Has room to rise above 7 before the red zone is reached.

Realized Cap: Steady upward slope, indicating increasing cost basis support.

Puell Multiple: Miners are profitable but not overextended — no capitulation risk.

This combination suggests the cycle is structurally healthy and not in terminal blow-off yet, which supports a continued advance through Q4 2025 and into early 2026.

Sentiment Layer: CBBI and Fear & Greed

CBBI at 73: We are near the historical midpoint of euphoria curves. Cycles typically peak in the 90–100 range.

Fear & Greed at 64: Rising steadily, but not overheated. There is no sign of marketwide euphoria—further supporting a sustained uptrend.

Risk Flags to Watch

Despite the bullish base case, the Acceleration Phase is the most volatile and deceptive part of the cycle. Monitor these risk triggers:

RSI divergence near or above 90 on daily/weekly charts

MVRV Z-score crossing 7.5–8.0

Fear & Greed >90 for more than 2 weeks

ETF inflows stalling or reversing while price accelerates

Elevated CME futures premiums and excessive long/short ratios

These signals may indicate the proximity to interim peaks or shakeouts, but they won't invalidate the broader structural projection unless multiple alignments coincide.

Conclusion

Bitcoin is currently exhibiting textbook Acceleration Phase behavior, supported by volatility structure, address profitability, sentiment progression, and technical continuation patterns. This time, the phase is happening with support from ETF demand, more developed decentralized infrastructure, and on-chain signals that suggest the trend will last longer, unlike previous cycles.

Based on decades of experience modeling technical systems and observing volatility-momentum feedback loops, I project that this cycle is far from over. The price path ahead includes:

$120K (May 2025 — Bitcoin Conference)

$160K (October 2025 — Halloween Phase Top)

$198K (December 2025 — Late-Cycle Euphoria)

$225K (May 2026 — Final All-Time High)

These projections are built on a convergence of measurable signals—not speculations—and will be updated as market behavior evolves. Until terminal risk signals appear across structural, sentiment, and on-chain metrics, the upside case remains in force.

You can sign up to receive emails each time I publish.

Link to the original Bitcoin White Paper: White Paper:

Dollar-Cost-Average Bitcoin ($10 Free Bitcoin): DCA-SWAN

Access to our high-net-worth Bitcoin investor technical services is available now: cccCloud

“This content is intended solely for informational use. It is not a substitute for professional financial or legal counsel. We cannot guarantee the accuracy of the information, so we recommend consulting with a qualified financial advisor before making any substantial financial commitments.