Bitcoin Weekly Technical & Protocol Report—Flag Ignited: Bitcoin's Acceleration Phase

The weekly bull flag resolves as M2 climbs, DXY softens, and on-chain heat stays mid-zone—measured move to $135k, path to $170k–$200k

Why this week matters

Bitcoin defended the 20-week EMA and kept pressing the prior bull-flag breakout. Momentum is constructive (weekly RSI in a bull range, MACD > 0), breadth is aligned across macro liquidity, miner thermals, and on-chain valuation, and protocol security remains stout. That’s my Acceleration Phase checklist.

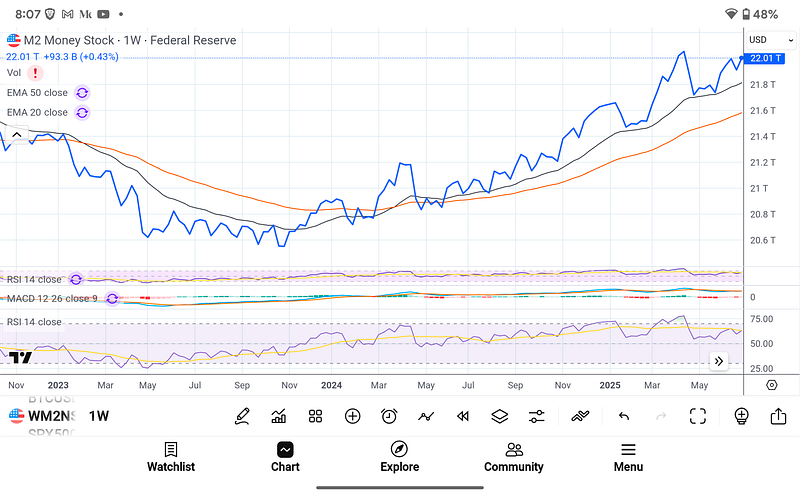

Macro liquidity: the fuel line is open

M2 continues to grind higher and sits above the 20/50-week EMAs. Each explosive leg in 2012, 2016, and 2020 began only after broad money had inflected upward. The slope is positive again—oxygen returning to rise.

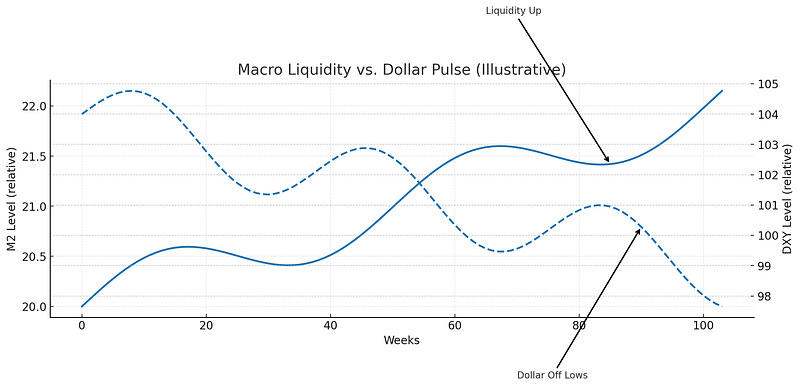

Dollar pulse: basing, not bullying

DXY is stabilizing in the high 90s after a sharp drawdown. Historically, a basing dollar during an M2 up-regime hasn’t capped Bitcoin; it often coincided with the market’s vertical chapter because the heavy USD unwinding already happened. If DXY only rallies into the underside of its 50-week EMA, Bitcoin will continue to benefit.

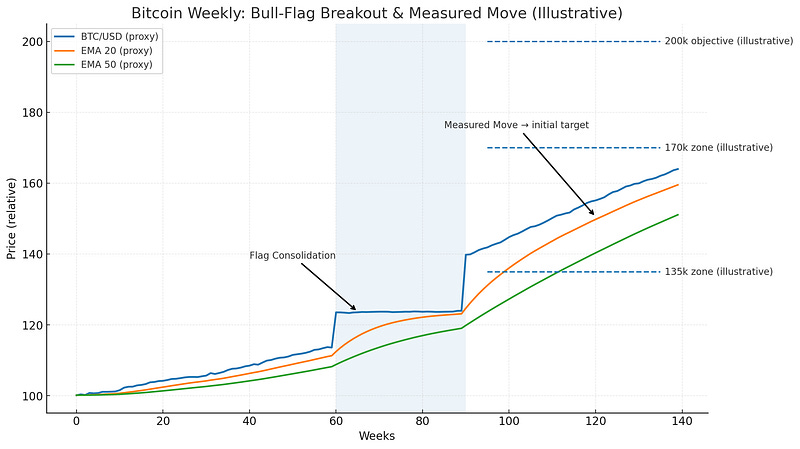

Market structure: the flag that launched it

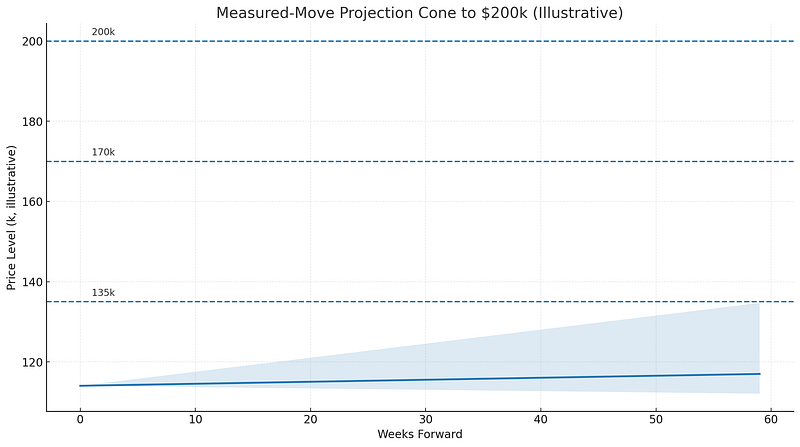

The two-month $93k–$114k range resolved higher on improving volume—textbook continuation.

• Measured move: range height ($21k) + breakout ($114k) ⇒ $135k initial target.

• Rails to respect: the rising 20-week EMA (~$100k) as the trend stop and the 50-week EMA (mid-$80k) as the cycle guardrail.

• The next confluence occurs above $135k, where supply is limited up to the range of $150k–$170k; with favorable liquidity conditions, the risk of overshooting could lead to a target of $200k by year-end.

Monthly posture remains firmly above the 20/50-month EMAs—exactly how late-2017 and early-2021 looked just before the final thrusts. Tight monthly candles at new highs are usually bases, not ceilings.

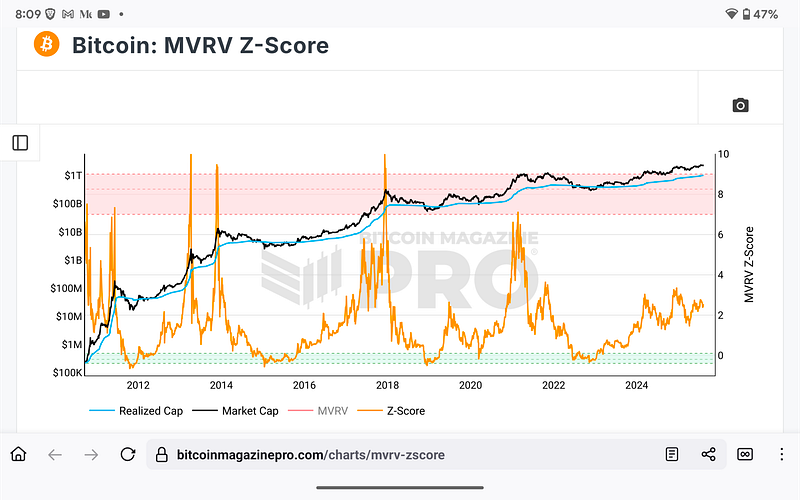

On-chain valuation: hot, not hysterical

MVRV Z sits around 2–3σ—holders are in profit but miles below the 7–10σ extremes that ended 2013, 2017, and 2021. That’s mid-cycle heat, not terminal euphoria.

Spot maintains a healthy spread over the realized price—typical of the Acceleration Phase, where the realized acts like a rising demand floor rather than a cap.

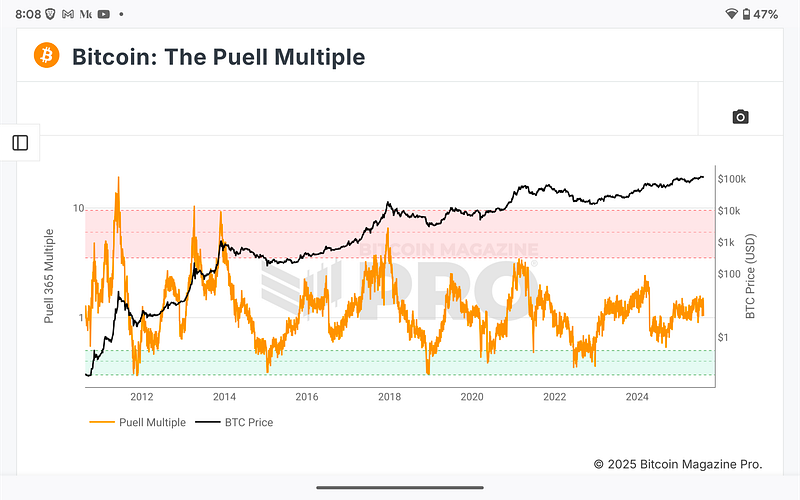

Miner thermals & issuance: strong, disciplined

The Puell multiple hovering near 1.7–1.9 indicates that miners are profitable without experiencing red-zone heat levels greater than 3.5–4.0. Post-halving issuance compression plus steady fees sustain hash-rate expansion and predictable block intervals.

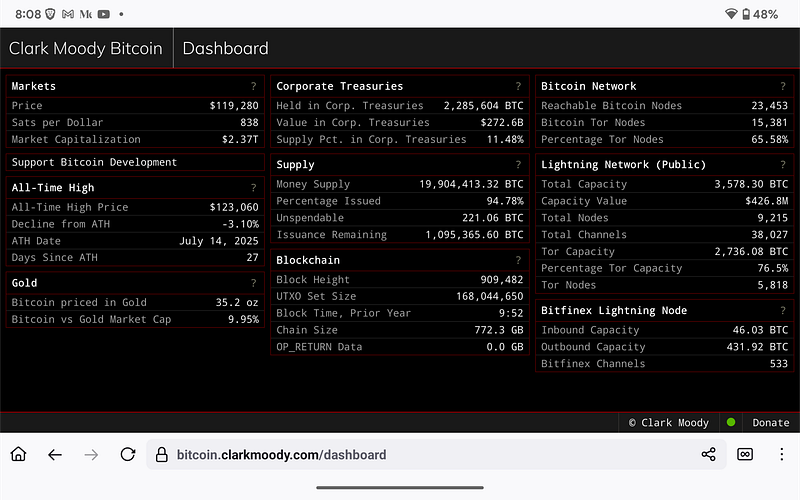

Network integrity & structural demand

Reachable and Tor nodes remain elevated; Lightning public capacity holds steady with a large Tor share, supporting performance and censorship resistance. Corporate treasuries retaining a double-digit share of supply is the structural bid unique to this cycle—and a key reason dips keep getting absorbed.

Scenario cone & risk rails

• Base case: push to $135k, brief digestion, then trend toward $170k into late Q4 as the liquidity slope persists.

• Stretch case: ETF/treasury accumulation + friendly macro → $200k print by year-end.

• Risk management: Keep risk defined at the 20-week EMA; loss of the 50-week would downgrade the phase and cap upside until rebuilt.

Conclusion: history doesn’t repeat, it compounds

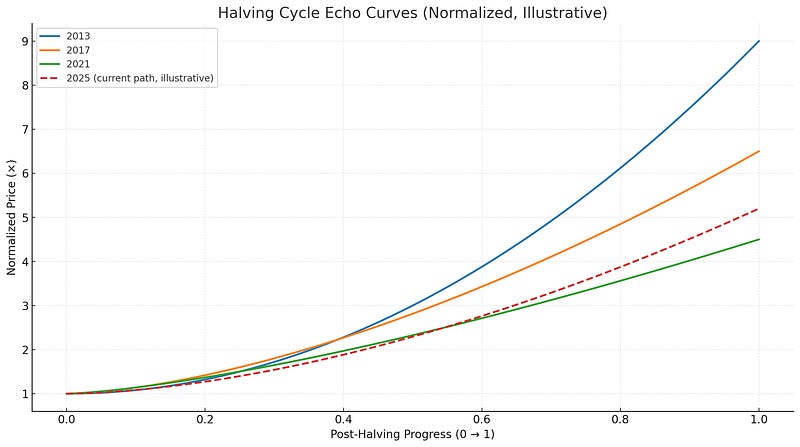

Every cycle’s late stage shares the same rhythm: liquidity turns up, the dollar stops biting, on-chain profitability warms but stays south of mania, a bull flag resolves, and then price goes vertical.

2013: five-week base at highs → ~4.5× sprint.

2017: four-week flag → ~3× run.

2021: tight range → ~2.3× surge.

We have the same cocktail now: rising M2, a non-hostile dollar, miners profitable without overheating, realized price rising under spot, Lightning capacity and node counts strengthening, and a historically large corporate sequestration of supply. The measured move of $135k for the flag appears to be the first step. If liquidity remains cooperative, the highest-probability path is a stair-step toward $170k, with momentum-driven overshoot potential into $200k by the annual close. Risk stays defined at the 20-week rail; the opportunity remains everything above it.

You can sign up to receive emails each time I publish.

Here's the link to the original Bitcoin White Paper:

Dollar-Cost-Average Bitcoin ($10 Free Bitcoin): DCA-SWAN

You can now access our high-net-worth Bitcoin investor technical services here: cccCloud

We solely intend this content for informational purposes. It is not a substitute for professional financial or legal counsel. We cannot guarantee the accuracy of the information, so we recommend consulting a qualified financial advisor before making any substantial financial commitments.