Bitcoin in Acceleration: The Final Third of the Cycle Is Now

Bitcoin Technical Analysis Report: Closing the Week on a Strong Bullish Note

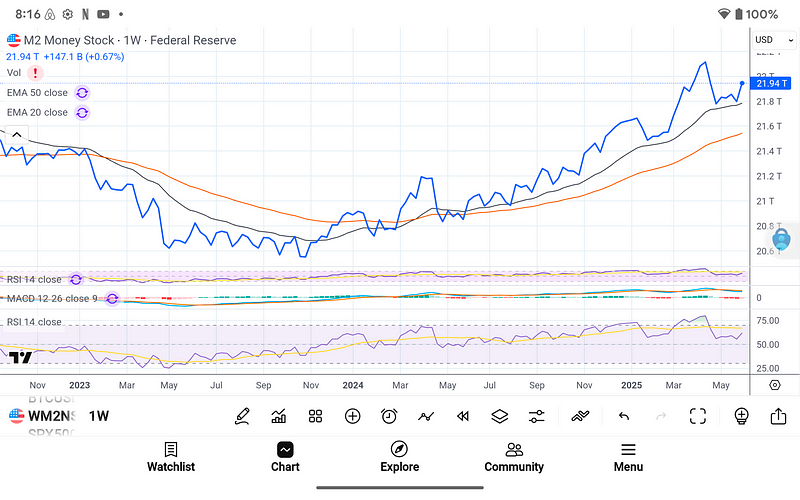

Macro Liquidity & Dollar Dynamics

This week’s weekly candle closed decisively above the 20-week EMA, but the true fuel comes from the macro backdrop. U.S. M2 Money Stock just recaptured its 50-week EMA at $21.94 trillion, reversing an 18-month downtrend. Simultaneously, the U.S. Dollar Index fell below its 50-week EMA at 97.8, re-creating the "liquidity up, dollar down" combination that initiated every significant Bitcoin rally in 2012, 2015, and 2020.

Weekly Price Structure & Bull-Flag Breakout

Bitcoin cleared $119k this week, closing above a steep bull-flag pattern with expanding volume and RSI surging back into the 70s. Classic bull-flag anatomy: a sharp rally → consolidation in a tight channel → high-volume breakout.

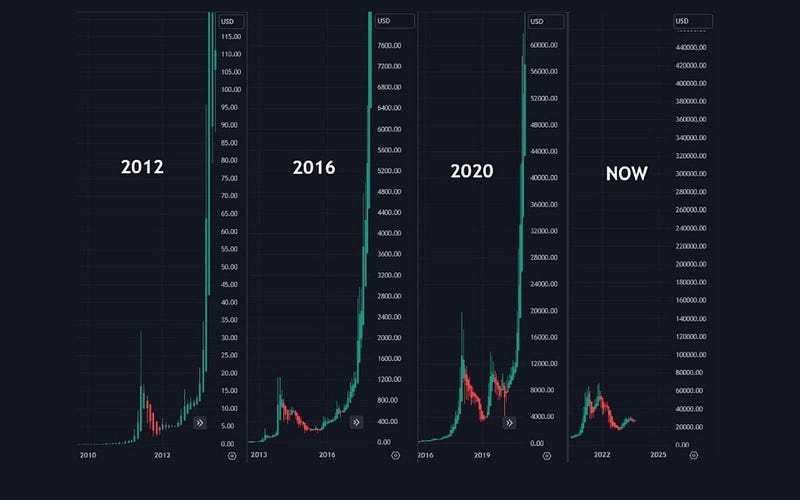

2015–16 Parallel: After the 2016 halving, Bitcoin rallied 4×, carved a shallow flag, then vaulted beyond $1k.

2018–19 Parallel: A bear-market bounce from $3k formed a tight flag before a 4× move into $13k.

2020 Parallel: Post-halving, BTC paused around $10k, then shot to $29k in three months.

The measured-move projection from our recent flag indicates an initial target near $127k ($110k + [$110k–$93k]), accompanied by a high-probability extension towards the $135k–140k zone, based on the convergence of Fib extensions and support/resistance bands.

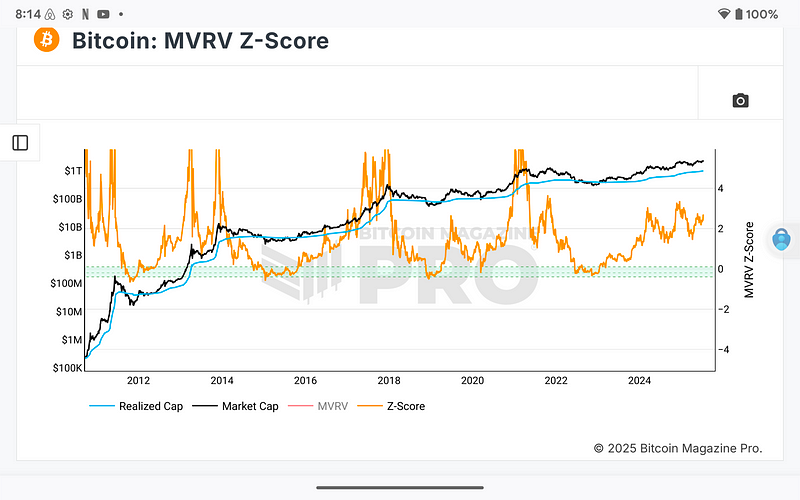

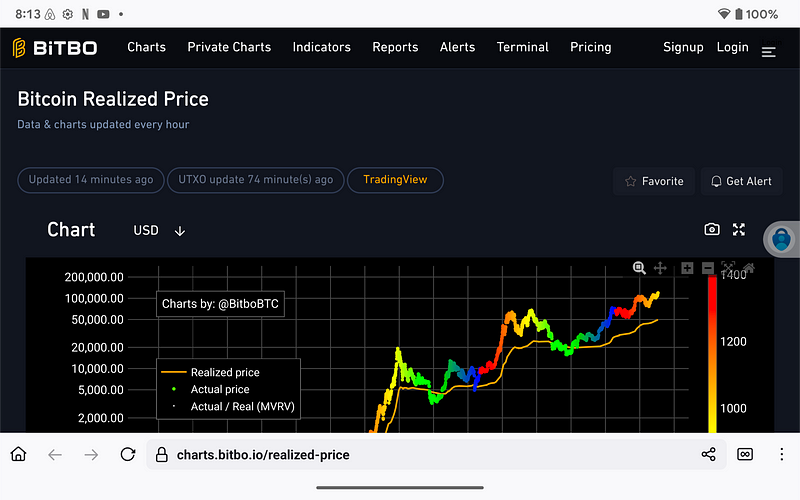

On-Chain Valuation & Profitability

The MVRV Z-Score sits around +3σ—hot, but a far cry from the +7–10σ peaks that marked prior cycle tops. Market-to-realized cap distance similarly trades above its long-term baseline yet well below blow-off extremes. These on-chain thermometers indicate that profitability is still robust without experiencing euphoria.

The realized price currently trades at approximately half of its spot value, precisely where mid-cycle runs typically anchor. When the actual price diverges too far above the realized price, risk spikes; today we’ve still got room to run.

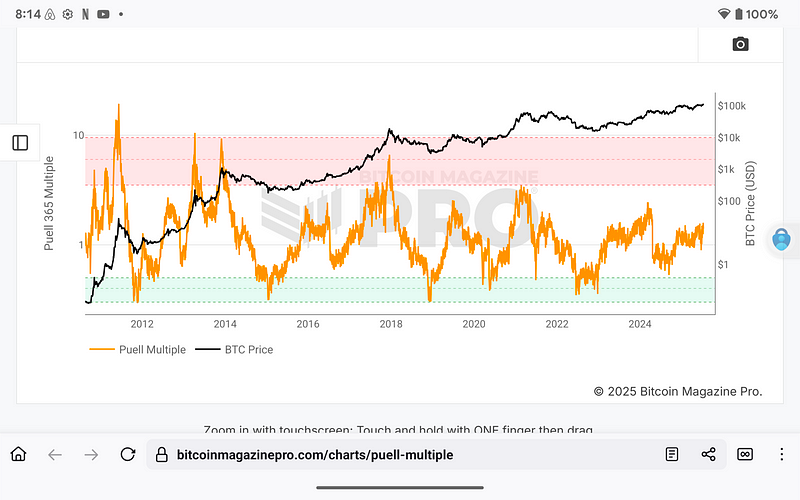

Miner Metrics & Network Health

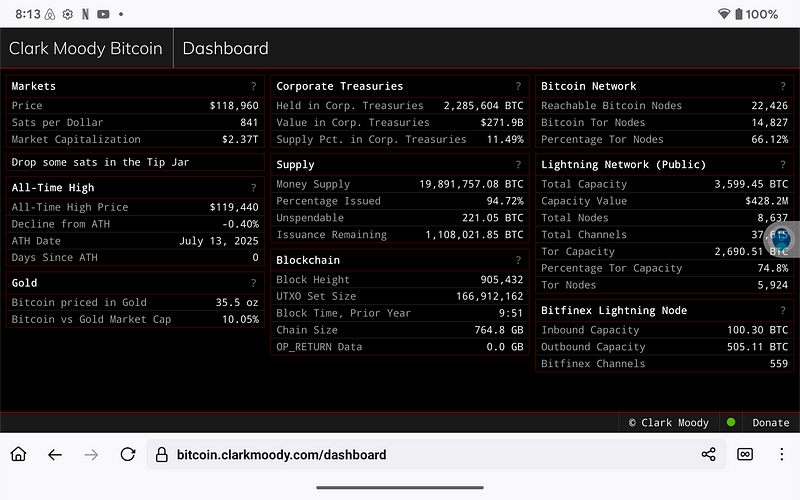

Puell’s 365-day multiple is currently at approximately 1.9, indicating that miners are generating healthy revenue without experiencing capitulation. The hash rate continues upward, cementing security. Lightning public capacity now exceeds 3,600 BTC—over 75% routed through Tor—bolstering censorship resistance.

Phase Classification & Probability Cone

Inputting ~94% addresses-in-profit and ~47% one-year realized volatility into our May-02 phase matrix pins us in the Acceleration Phase with 83% likelihood. Historically, Week 15 of Acceleration extends 24–32 weeks post-halving. Our probabilistic cone projects:

$155k by early September

A short consolidation

A final assault on $180k–195k into Q4

Sentiment & Risk Barometers

CBBI stands at 80 (“caution”), while Fear & Greed reads 74 (“greed”). Enthusiasm has heated; mania-level readings (CBBI > 95) remain distant. The market is currently warming up, not overheating.

Security Corner & Structural Demand

My Knocts node at block 905,432 confirms full sync; on-chain software stats align with no anomalies. Corporate treasuries now lock up 11.5% of supply—an institutional bid without precedent. Scarcity mechanics tighten as leverage dries up on exchanges.

Historical Echo & Tactical Takeaway

July 2025 mirrors In July 2017, liquidity was pivoting higher, the dollar was weakening, on-chain heat was building, and the price was forging a new all-time high six months after the halving. In 2017, BTC tripled from that juncture; in 2021, it doubled. If macro tailwinds remain intact, splitting the difference targets $180k–195k by year-end.

The weekly close of Bitcoin not only confirms the Acceleration Phase, but also indicates a parabolic finish to 2025. The flood of fresh liquidity, combined with a weakening dollar, has reignited every post-halving leg in Bitcoin’s history, and this cycle is no exception. Miners remain steadfast, collecting record revenues without capitulation; hash rate and Lightning capacity keep climbing, cementing network security and utility. On-chain valuation gauges—MVRV, realized price, and Puell Multiple—are hot, yet still shy of mania thresholds, indicating ample room for buyers to chase price higher without fear of immediate exhaustion.

Sentiment metrics confirm that the market is heating up, but not overheating. CBBI and Fear & Greed remain in the "caution"/"greed" range, leaving the most extreme extremes behind. Meanwhile, the textbook bull-flag breakout above $125k, accompanied by expanding volume, an RSI in the low 70s, and a measured-move target around $135–140k, has already paved the way for a sustained upward trajectory. Historical parallels from 2016 and 2020 show that once Bitcoin snaps a bull flag under these conditions, it doesn’t merely reach measured targets—it overshoots them on follow-through momentum.

Using the current profit and volatility data, our calculations suggest there is an 83% chance that Bitcoin will keep rising steadily through the fourth quarter, leading to a final surge that surpasses all previous highs. Projecting the same cycle dynamics that powered Bitcoin from $20k to $69k in 2021 and from $3k to $20k in 2017 aligns closely with a year-end print near $200,000. The $200,000 figure is just within the highest limits of our power-law bands and Fibonacci extensions, and it highlights the strong demand held by corporate treasuries, which now own 11.5% of the total supply, providing consistent support during price dips.

In plain terms, if you believed in Bitcoin’s 4× run in 2016 or its 3× surge in 2020, prepare for a 1.7× lift from today’s levels to wrap 2025 around $200k. Dynamic stops at the rising 20-week EMA (~$93k) keep risk in check, but the upside runway is now measured in hundreds of thousands, not tens. Strap in—the measured-move ascent is underway, and year-end near $200k is not just plausible, it’s the most probable outcome for this cycle’s grand finale.

You can contribute to each article by clicking on the link at the bottom.

You can sign up to receive emails each time I publish.

Here is the link to the original Bitcoin White Paper:

Dollar-Cost-Average Bitcoin ($10 Free Bitcoin): DCA-SWAN

Access to our high-net-worth Bitcoin investor technical services is available now: cccCloud

We solely intend this content for informational purposes. It is not a substitute for professional financial or legal counsel. We cannot guarantee the accuracy of the information, so we recommend consulting a qualified financial advisor before making any substantial financial commitments.