Bitcoin Consolidates Near Record Highs: Neutral Sentiment, Strong On-Chain Support

Liquidity expansion, corporate adoption, and historical precedent point toward Bitcoin's next major breakout

Price Action and Technical Structure

Bitcoin trades at $113,600, consolidating just below its all-time high of $124,400 set on August 13, 2025. The weekly chart shows BTC holding above the 20-week EMA ($105K) and the 50-week EMA ($92K), confirming an intact bullish structure.

The RSI sits near 54, reflecting neutrality, while the MACD remains positive but shows early signs of momentum cooling. This consolidation is orderly—buyers are consistently defending the $110K–$112K level, preventing deeper drawdowns.

At –8.7% below ATH, Bitcoin’s pullback is historically shallow. In past cycles, retracements of 20–30% near highs were common before new breakouts. The muted nature of this correction suggests strong underlying demand and structural support.

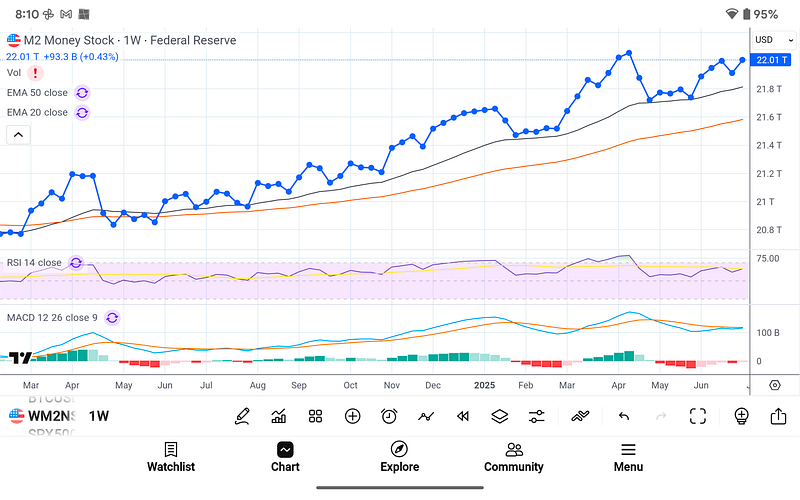

Macro Backdrop—Liquidity and the Dollar

The M2 Money Supply has reached $22.01T, expanding by over $93B week-over-week. Both the 20-week and 50-week EMA trends remain strongly positive, showing that systemic liquidity expansion continues. Historically, periods of sharp monetary growth—such as 2020–2021—aligned with Bitcoin’s most powerful bull runs.

The U.S. Dollar Index (DXY) trades near 97.9, continuing its broader downtrend from 2024 highs above 107. RSI remains weak at 44, while MACD trends negative despite minor recent upticks. A weakening dollar historically correlates with Bitcoin strength, as seen in both the 2016–2017 and 2020–2021 cycles. The present environment mirrors those same liquidity and currency dynamics.

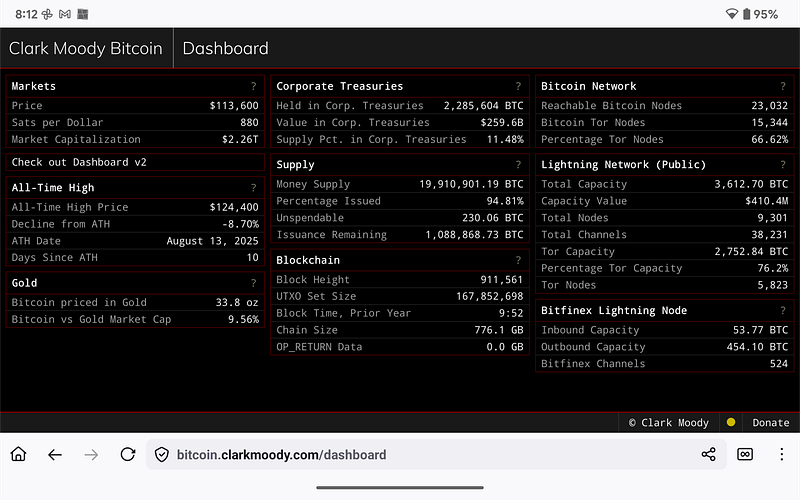

On-Chain Fundamentals—Clark Moody Dashboard

On-chain data provides deeper context:

Market Cap: $2.26T

Corporate Treasuries: 2.28M BTC (~11.5% of supply) worth $259B

Supply Issued: 94.8% of all BTC (19.91M)

Lightning Network: has a capacity of 3,612 BTC, which is valued at $410 million, distributed across 9 channels and 301 nodes.

Corporate balance sheets now hold nearly one-eighth of all circulating Bitcoin. This is a structural change compared to earlier cycles where institutional and sovereign adoption was minimal. The Lightning Network’s growth adds resilience, scaling Bitcoin as both a settlement layer and payment system.

On-Chain Valuation Metrics

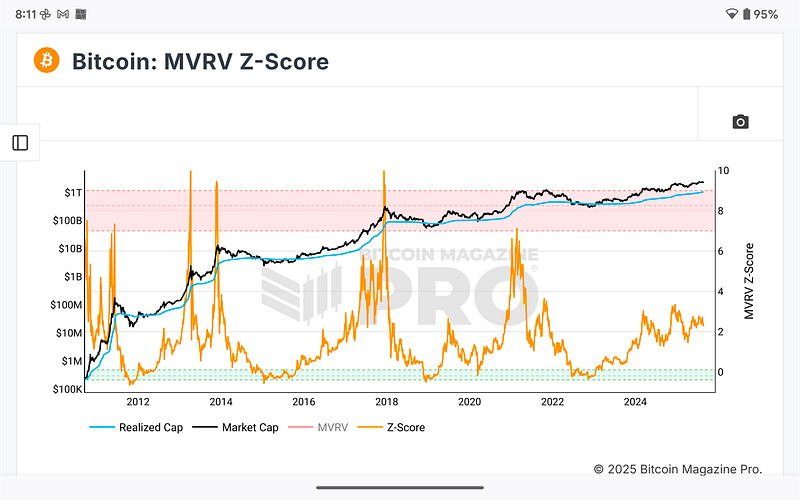

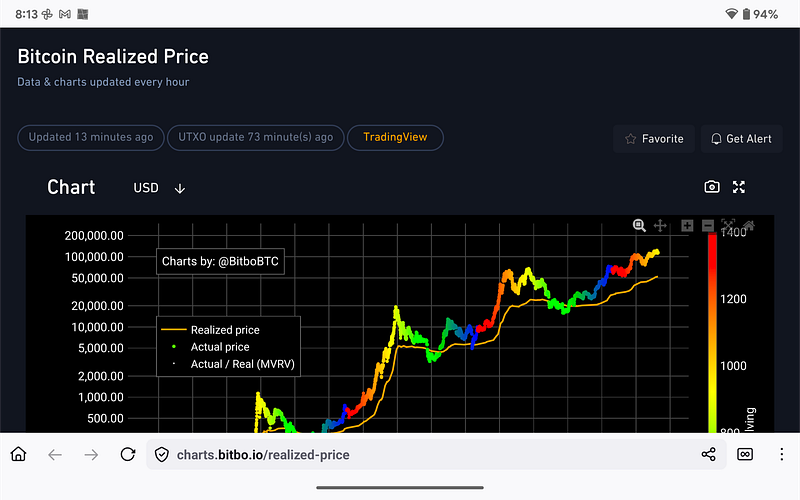

Realized Price and MVRV

The Realized Price chart shows Bitcoin’s actual traded value relative to its realized value on-chain. The current market price remains comfortably above the realized price, meaning the majority of holders are in profit. The MVRV ratio is not yet at overheated levels. Historically, peaks in the MVRV above 3.5–4 have marked cycle tops. Today’s readings are far more measured, suggesting there is still substantial upside potential.

The MVRV Z-Score reinforces this view. Extreme highs above 7–8 have always signaled tops (2013, 2017, 2021), while lows near 0 marked cycle bottoms. Current Z-score levels remain mid-range, far from overheated territory.

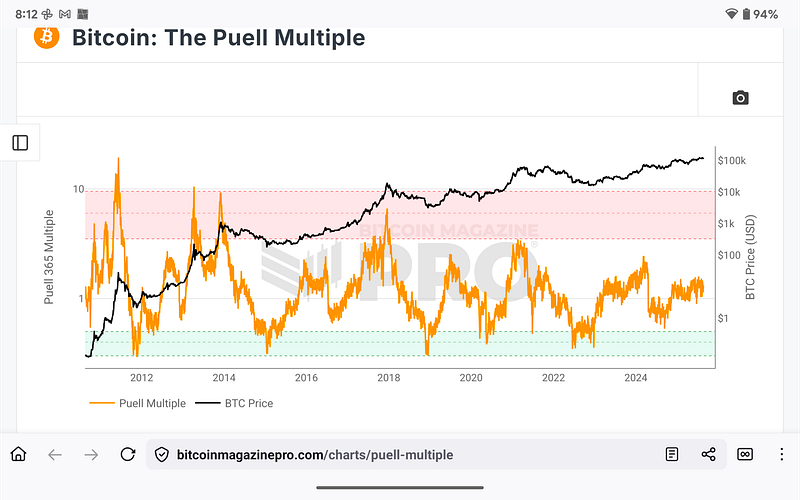

The Puell Multiple

The Puell Multiple tracks miner revenue relative to its one-year average. Historically, spikes into the red zone above 4–6 signaled miners distributing heavily into overheated markets, while deep drops into the green zone marked miner capitulation at bottoms.

Today, the Puell Multiple is in a healthy mid-range. This signals that miners are neither stressed nor aggressively selling into the market. This miner stability strengthens Bitcoin’s supply dynamics, reducing sell pressure and reinforcing the sustainability of prices above $100K.

Sentiment—A Market That Doesn’t Believe Yet

The CBBI sits at 77, indicating heat but not euphoric levels. The Fear & Greed Index at 47 reflects neutrality leaning toward fear.

This combination—Bitcoin near all-time highs while sentiment remains cautious—is historically rare and bullish. In both late 2016 and early 2021, Bitcoin advanced much further when sentiment was hesitant even as price pressed record levels. A lack of mania means the market has not exhausted its upward potential.

Historical Perspective

2013: Bitcoin surged from $13 to $1,100 in its first parabolic cycle. Both MVRV and Puell Multiple spiked into extremes, signaling overheating before the crash.

2017: Price soared from $1,000 to $20,000, with the MVRV Z-Score exceeding 8 and the Puell Multiple peaking as miners distributed into mania.

2021: Bitcoin’s run to $64K and later $69K was accompanied by MVRV spikes above 7 and Puell Multiple stresses, showing classic signs of cycle overheating.

2025: By contrast, Bitcoin hovers near $114K with neutral sentiment, measured on-chain valuations, and miner stability. The absence of classic blow-off signals suggests the current cycle may extend further than previous ones.

Conclusion—Building the Base for the Next Move

Bitcoin is consolidating near record highs, with strong macro tailwinds, growing corporate adoption, and resilient on-chain fundamentals. The Realized Price and MVRV Z-Score show profitability but no mania. The Puell Multiple indicates miner stability, not stress. The CBBI and Fear & Greed Index reveal caution, not euphoria.

History tells us that shallow pullbacks near highs, coupled with neutral sentiment, have always preceded major continuation rallies. With expanding liquidity and a weakening dollar, Bitcoin’s next breakout has a strong foundation.

Short-Term Outlook: Sideways consolidation between $110K and $120K, with a breakout likely on a close above ATH.

Medium-Term Outlook: Macro and on-chain conditions strongly support a run toward $150K–$180K.

Long-Term Outlook: The cycle projection remains in the $220K–$250K range, with the possibility of an extended, less volatile cycle compared to 2017 and 2021, driven by institutional and sovereign demand.

Bitcoin’s history is a story of disbelief before parabolic advance. Today’s environment—with cautious sentiment, neutral fear levels, and macro support—suggests that the most powerful phase of this cycle may still lie ahead.

You can sign up to receive emails each time I publish.

Here is the link to the original Bitcoin White Paper:

Dollar-Cost-Average Bitcoin ($10 Free Bitcoin): DCA-SWAN

Access to our high-net-worth Bitcoin investor technical services is available now:cccCloud

We solely intend this content for informational purposes. It is not a substitute for professional financial or legal counsel. We cannot guarantee the accuracy of the information, so we recommend consulting a qualified financial advisor before making any substantial financial commitments.